Financial Professionals

Thanks again for your interest in Pivotal/Cambridge!

We look forward to answering your questions about a potential transition to Cambridge Investment Research, Inc (Broker Dealer) and Cambridge Investment Research Advisors (Registered Investment Adviser), as applicable. Our goal is to make sure you have what you need to make an informed business decision for your business interests.

We feel fortunate to work with/for many independent financial professionals as they grow outstanding practices (see Who We Are then Financial Professionals Network above). As a reminder, Pivotal Financial Advisors LLC are an external Office of Supervisory Jurisdiction located in Fort Worth, TX. We joined Cambridge back in 2008 and are not producers (other than a few family/friends); rather, we work daily for financial professionals offering our insight and experience upon request.

Please visit our entire website and review what we do as an external OSJ with Cambridge Investment Research, Inc (Broker Dealer) and Cambridge Investment Research Advisors (Registered Investment Adviser). I’d like to direct your attention to our “Team” under the Who We Are then Pivotal Financial Advisors above to better understand the depth of assistance that will be available for you now and ongoing. See our “On Your Own but Not Alone” brochure regarding the entire value proposition.

Here are some additional sites with information about Cambridge to offer culture, leadership, etc.

Click on the items below to learn more about us and how we work.

Next Steps

Get accepted at Cambridge “Green Light” when you are ready.

Use the links below to start your journey.

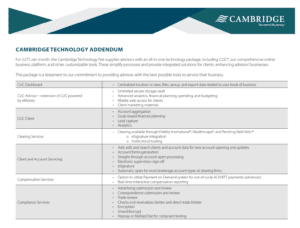

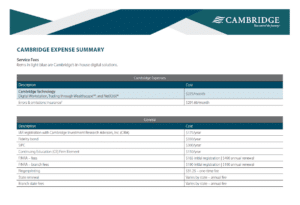

Technology:

Technology demos are available upon request.

CLIC Dashboard: a centralized location to view, filter, group, and export data related to your book of business.

CLIC Advisor: Powered by eMoney, CLIC Advisor features a secure storage vault, advanced tools for financial planning, spending, and budgeting, mobile access for clients, and more!

CLIC Client: Provides client access to accounts, a secure client vault, financial planning reports, etc.

Clearing Services: Clearing is available through Fidelity Institutional®, Wealthscape®, and Pershing NetX360+®

Client and Account Servicing: Add/edit/search clients and accounts, forms generation, eSignature, and auto-open most brokerage accounts

Compensation Services: Real-time compensation reporting and Payment on Demand system

Compliance Services: Advertising/correspondence submission and review, trade review, checks and receivables blotter, and direct trade blotter

Imaging Services: Web-based document image capture and submission to home office, search and retrieve account paperwork, and document storage

Managed Account Services: Fee Billing and WealthPort®

Retirement Center: Centralized location to view 401(k) plans

Office Services and Back-office Ecosystem: Paperwork status monitoring and service tickets with document upload